- 管理員

- Feb 08, 2024

- 汽車新聞

- Read: Small Medium Large

Malaysia Car Sales hit all all time high at 799,731 units in 2023 - MAA

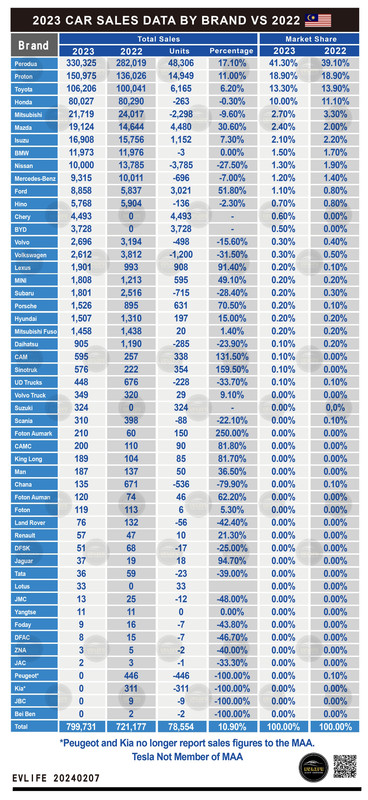

In 2023, the Malaysian automotive industry achieved remarkable success, with a total of 799,731 vehicles sold. This represents an impressive 11% increase compared to the previous year's sales of 721,177 units. Let's delve into the details:

1. Perodua maintained its position as the market leader, surpassing expectations by delivering 330,325 vehicles in 2023—an astounding 17.1% increase from the previous year.

2. Proton also had a good year, selling 150,975 vehicles (up by 11%), finally reaching its 150,000 target.

3. Together, the two national carmakers captured a 66.9% market share, the highest since 2002.

4. Toyota remained the closest non-national challenger, reporting a marginal increase of 6.2% to 106,206 units.

5. Honda maintained virtually flat sales at 80,027 units.

6. Mazda experienced an impressive surge, with sales shooting up by 30.6% to 19,124 units.

7. Ford posted a significant increase of 51.8% in sales, reaching 8,858 units.

8. Nissan faced a decline of 27.5%, selling around 10,000 units.

9. Volkswagen and Subaru also experienced substantial losses.

10. In the premium segment, BMW and Mercedes-Benz maintained their positions.

11. Notably, electric vehicle sales rose, led by BYD, which entered the market in 14th place with 3,728 vehicles sold.

Overall, the automotive industry in Malaysia witnessed growth and diversification, with both established players and emerging brands contributing to the dynamic landscape.

Total car sales data 2023 - source MAA

BMI, a Fitch Solutions company, maintains a cautious outlook on Malaysia's vehicle market for 2024 and 2025. Despite revising the 2023 forecast upward, they anticipate challenges due to high base effects that could disrupt the record sales achieved this year. The local auto market may face some difficulty, resulting in a modest 1.0% growth in sales for 2024 and a 0.5% contraction in 2025.

However, there are positive factors to consider:

- High economic growth levels, a dynamic economy, and elevated income levels continue to attract investments in high-tech sectors like semiconductor manufacturing.

- The pent-up demand for vehicles during the sales tax exemption period exceeded expectations, leading to better-than-anticipated sales in 2023.

- Electric vehicle (EV) demand is expected to outpace internal combustion engine (ICE) cars within the 2023 to 2032 forecast period. Although the EV penetration rate remains low at 1.8%, initiatives such as import duty exemptions and tax incentives drive Malaysia's prospective EV growth.

In summary, while challenges lie ahead, Malaysia's automotive industry remains dynamic, with opportunities for growth and adaptation.